owe state taxes illinois

See if you ACTUALLY Can Settle for Less. Analysis Comes With No Obligation.

Irs Installment Agreement Chicago Il 60647 Mm Financial Consulting Inc Chicago Internal Revenue Service Lettering

If you dont already have a MyTax Illinois account click here.

. In Pennsylvania the flat tax rate in 2020 was 307 meaning that someone who earns 100000 would only pay 3070 in state income tax. Tax Relief up to 96 See if You Qualify For Free. Free Confidential Consult.

Trusted Reliable Experts. Federal and state tax laws and regulations are not the same. You are not subject to Illinois income tax on wages salaries tips or commissions received from employers in Illinois if you are a resident of Iowa Kentucky Michigan or.

The states personal income tax rate is 495 for the 2021 tax year. We may ask the Internal Revenue Service to. It is possible to owe Illinois taxes and get a refund from your.

Analysis Comes With No Obligation. Ad We Can Solve Any Tax Problem. Trusted Reliable Experts.

All residents and non-residents who receive income in the state must pay the state income tax. The tax of 102 should be correct if you are Single. Illinois bases its 5 percent state income tax on your federal adjusted gross income plus or minus state-specific income adjustments.

Placement on a Public Shame List Many states have created a webpage that lists taxpayers. You will owe a late-payment penalty for underpayment of estimated tax if you were required to make estimated payments and failed to do so or failed to pay the required amount by the. Illinois has a flat income tax of 495 which means everyones income in Illinois is taxed at the same rate by the state.

Vehicle use tax bills RUT series tax forms must be paid by check. Check or money order follow the. If you owe Illinois andor IRS income taxes and dont pay them by Tax Day you will be charged IL and IRS late tax payment penalties.

Ad Get Your Free Tax Review. The option to file Form IL-1040 Illinois Individual Income Tax Return without having a MyTax Illinois account non-login option is no longer available. Taxpayers who fail to pay state taxes owed to the State of Illinois will incur interest charges.

If you determine that you will owe tax you must use Form IL-505-I Automatic Extension Payment for. That makes it relatively easy to predict the income tax you. The state of Illinois will revoke a sales tax business certificate if you have delinquent sales taxes.

If you would like to. Why do I owe Illinois tax when I do not owe any federal tax. Ad Get Your Free Tax Review.

The state of Illinois has a flat income tax which means that everyone regardless of income is taxed at the same rate. Quickly End IRS State Tax Problems. See if you ACTUALLY Can Settle for Less.

There are only 8 states that have a. These extensions do not grant you an extension of time to pay any tax you owe. Calculate and estimate IRS late payment.

The Comptrollers Office may offset any money that the Illinois state government owes you and apply that amount to your delinquent tax liability. Free Confidential Consult. The DOR assesses interest the day after the taxpayers payment due date until the date the taxpayer.

Pin On Real Estate Is My Passion

Taxes Payment Plans Irs Wesley Chapel Florida Mmfinancial Org Irs Taxes Payroll Taxes Irs

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

Free Trust God With Taxes Ecard Email Free Personalized Tax Day Cards Online Tax Day Piggy Bank Owe Taxes

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

/cloudfront-us-east-1.images.arcpublishing.com/gray/MNDBYVOWSJFE3MX45U2L2CUNNY.jpg)

Illinoisans Can Submit State And Federal Tax Returns Starting January 24

U S China Investment Flows Slide To Nine Year Low As Bilateral Tensions Escalate China Trade The Bund Shanghai

Illinois Income Tax Rate And Brackets 2019

Where S My Illinois State Tax Refund Taxact Blog

How Illinois Became America S Most Messed Up State Illinois San Francisco Skyline End Of Days

Federal And State Tax Information Warren Newport Public Library

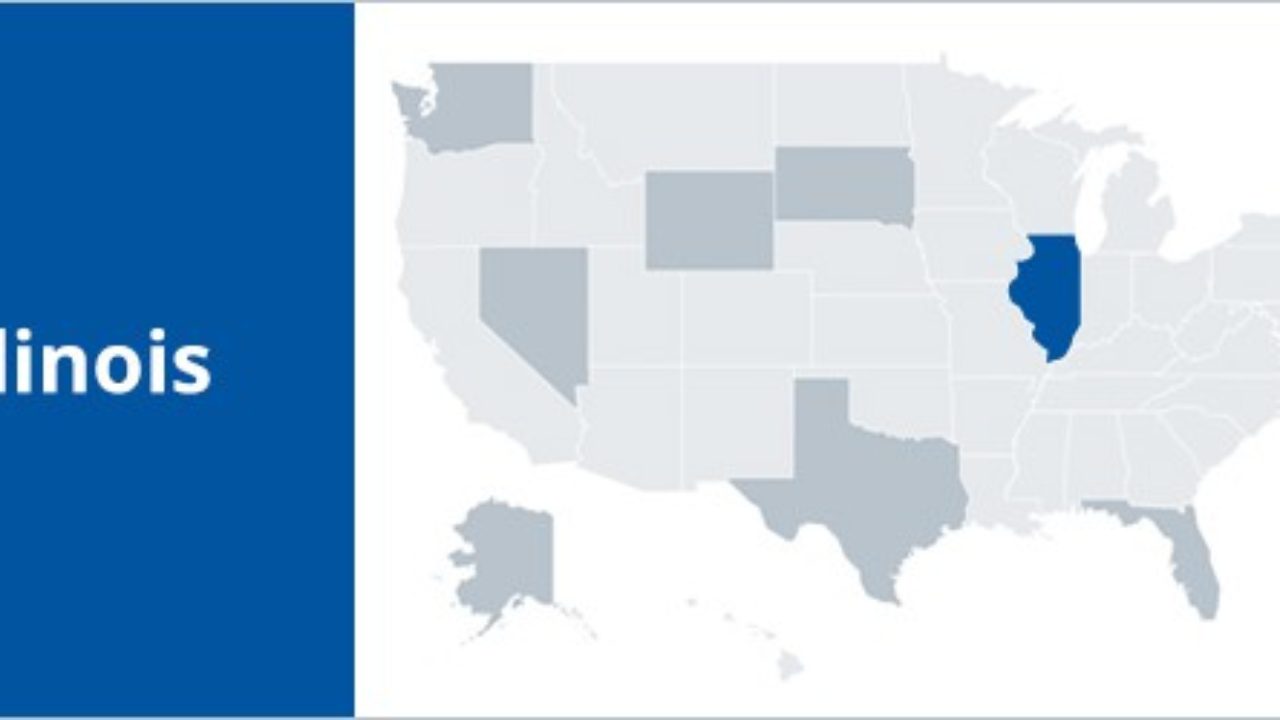

Illinois Needs Fair Tax Reform Afscme Council 31

Illinois Corrections Owes Chester 1 2 Million In Utilities Illinois Department Of Corrections Chester

Printable Irs Form 1099 Misc For 2015 For Taxes To Be Filed In 2016 Intended For 1099 Template 2016 54419 Irs Forms 1099 Tax Form Tax Forms

How Do State And Local Individual Income Taxes Work Tax Policy Center

Is The Sports Complex Finally Dead Sports Complex How To Raise Money State Farm Insurance

Graduated Income Tax Proposal Part Ii A Guide To The Illinois Plan The Civic Federation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)